|

california medical insurance for pets: choosing with clarityWhat changes the calculus in CaliforniaCare is excellent and costly. Urban ER clinics stay busy late; rural drives add time and stress. Wildfire smoke, foxtails, coastal allergies, and the occasional rattlesnake reshape risk. Prices swing on weekends. That variability is exactly why a plan that spells out limits, reimbursements, and exclusions with plain words earns trust. Build a simple selection framework- Map your pet's risk. Age, breed tendencies, outdoor exposure, and local hazards. Ask your vet to note top likely conditions in the chart; use that list as your coverage checklist.

- Decide how you want to share costs. Annual deductible vs per-incident, 70 - 90% reimbursement, and annual limits. Higher deductibles lower premiums but raise the "bad day" bill.

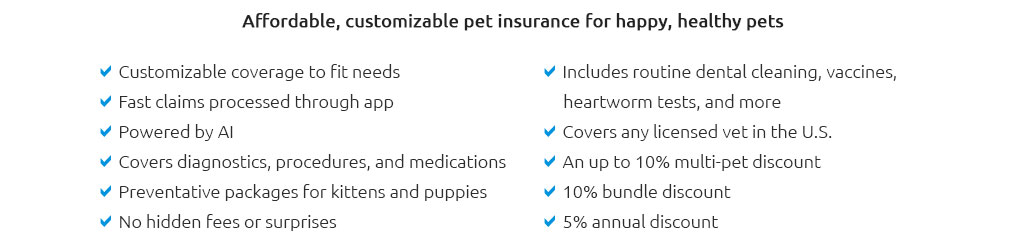

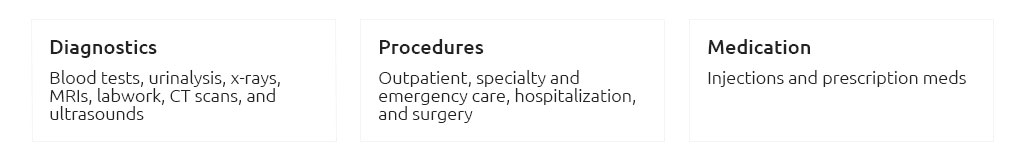

- Verify core coverages. Illness, accidents, hereditary conditions, diagnostics, imaging, hospitalization, surgery, Rx meds. Check if exam fees are covered, and how dental illness is handled.

- Surface exclusions early. Look for pre-existing conditions, bilateral limits (e.g., one knee vs the other), breed-specific restrictions, and waiting periods for cruciate injuries.

- Check the claim reality. Typical flow is you pay the vet, then claim. Direct pay is rare; processing time and documentation needs matter more than slogans.

- Assess transparency. Can you download the full policy before buying? Are rate-change factors described in writing? California requires clear disclosures; many carriers also offer a 30-day "free look" refund if no claim is filed.

The money mechanicsOne quick model: bill $2,400; annual deductible $250; reimbursement 80%; no limits hit. You pay the first $250, then 20% of the remainder. Insurer pays ($2,400 − $250) × 0.80 = $1,720. Your total out-of-pocket is $680. Small changes in deductible or reimbursement move these numbers a lot - run a few scenarios before you commit. Policy types and add-ons- Accident-only: Cheapest, narrow. Useful if you're mainly hedging trauma risk.

- Accident + illness: The standard. Look closely at hereditary, dental illness, and chronic condition provisions.

- Wellness add-on: Predictable costs like vaccines and cleanings. Sometimes convenient, not always economical; compare against your vet's price list.

Regional realities and accessMost plans let you visit any licensed vet in the U.S.; no network hoops. ER and specialty hospitals usually won't take payment from insurers directly, but many will submit claims on your behalf while funds reimburse you. That distinction matters on a Sunday night. Questions that reveal transparency- Can I see the full policy and a sample claim form before purchase?

- What are average claim processing times and denial rates last year?

- How are premiums adjusted at renewal - age, location, veterinary inflation - spelled out in writing?

- Are exam fees, Rx diets, rehab/physical therapy, and behavioral treatment covered?

- What are waiting periods, especially for cruciate or hip conditions? Any bilateral wording?

- Do you cover tele-triage or after-hours consult fees?

A small, real momentAt a Santa Rosa urgent-care clinic on a smoky Sunday, a terrier with a swallowed sock came in fast. The estimate: $1,850 if endoscopy went smoothly. The front desk said, kindly but firmly, "We don't bill insurers; you'll file." The owner tapped their app, confirmed an 80% reimbursement after a $250 deductible, and handed over a card. Not glamorous - just a clear plan working under pressure. Often-overlooked details- Bilateral clauses: Treating one knee can affect coverage for the other.

- Dental illness vs accident: Fractures differ from periodontal disease.

- Chronic meds and monitoring: Thyroid, allergies, seizures; ask if caps apply.

- Rehab and alternative therapies: Laser, acupuncture, hydrotherapy - explicitly list them.

- Special incident fees: ER/exam surcharges, after-hours consults, medical waste fees.

- Claim documentation: SOAP notes, invoices, itemized codes - know what's required.

Light comparison lens- Essential: Higher deductible, lower premium, accident + major illness. Protects against financial shock; you handle routine costs.

- Balanced: Mid deductible, 80% reimbursement, moderate annual limit. Broad protection with manageable monthly spend.

- Comprehensive: Low deductible, 90% reimbursement, high limit + wellness. Eases variability, costs more now to smooth later.

What stays in fluxVeterinary techniques advance, prices shift, and your pet's risk profile changes with age and routine. Revisit your choice at renewal, keep notes from your vet, and favor insurers that publish what others only imply; the rest tends to follow.

|

|